How do I get my financial plan?

Find out how to create your own customized financial plan and what you need to do so. We will give you an insight into the subject and provide you with documents to help you draw up your own financial plan.

Now, and especially at the beginning, you are in the driving seat and take your future into your own hands. As an introduction, we will give you an insight into the subject matter and provide you with tools to help you create a financial plan.

Because with a little support and good guidance, you will learn how to create your own personal and customized financial plan and what you need to do so.

Personal financial planning made easy

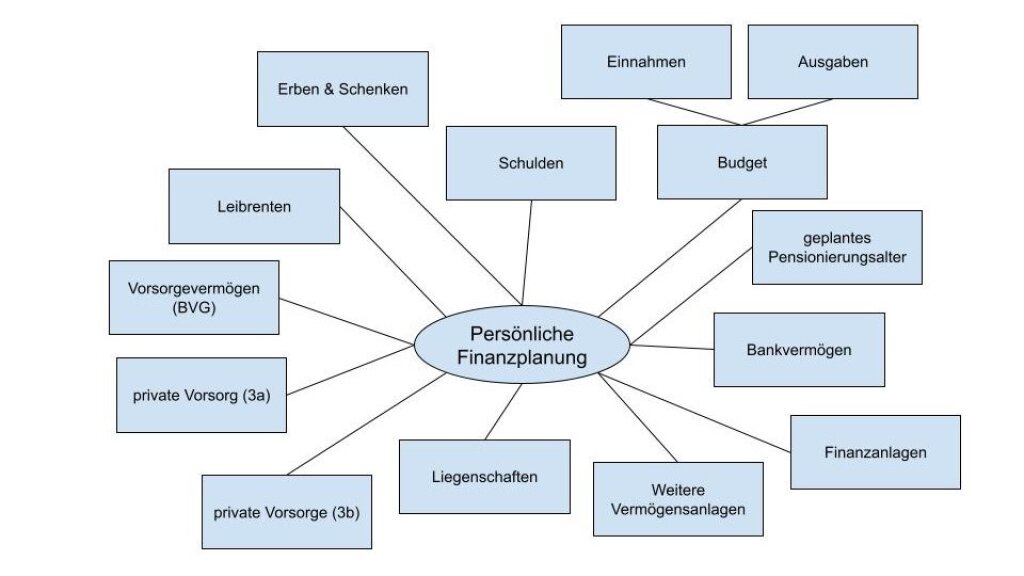

Whatever the purpose, whether for divorce, the planned purchase of a property, retirement or company succession, planning is always based on an in-depth analysis of your current life situation, your needs, ideas and goals, basic financial data such as budget, assets and debts.

Based on your current financial situation, personal financial planning provides an overview of the long-term development of your budget and the associated assets, taking into account the relevant variables. This enables you to make the big decisions of your life on a rational basis, become aware of any financial gaps and recognize where there is a need for optimization. With timely planning, you can use the scope for suitable measures that have a tax-optimizing effect and thus increase your net disposable income in the long term.

With these documents you are in!

The elements shown in the diagram show the basic documentation requirements. Much of the required information can already be seen in the tax return, which summarizes a large part of the information in a concentrated form. Another important document is the pension certificate from the pension fund. Depending on your personal situation, the documentation can or must be expanded as part of the information gathering process. We will be happy to provide you with a detailed checklist.

Your input for your customized financial plan

A tailor-made financial plan requires an analysis of the current and future life situation. In addition to the asset status, this includes current income and expenditure. Income ranges from salary or income from self-employment to income from securities, dividends and property income. The breakdown of annual expenditure is somewhat more complex. A distinction must be made between fixed (e.g. rent) and variable (e.g. vacation) expenses, as well as reserves/provisions for investments. In this regard, we recommend recording the monthly expenses in an overview and extrapolating them to one year. This should also include "cushions" and one-off expenses to allow for any eventualities in the planning. We will be happy to provide you with a suitable budget calculator for this purpose.

All significant changes in income and expenditure must be taken into account in the future budget: What costs can be expected for the desired lifestyle, what income is available to finance it?

As much concrete information as possible on the foreseeable changes makes it easier to familiarize yourself with the planning and, if necessary, to develop variants and optimizations.

Et voilà - your personal financial plan

As is so often the case in life, preparation and the right advice are the be-all and end-all when drawing up a personal financial plan. That's why we advise:

to contact us for the specific procedure;

to obtain the necessary documents;

discuss your current and future situation with our specialists in an initial consultation; and

After the final meeting and with the professionally prepared financial plan, you will be well prepared for the next phase of your life.

Contact the rta team for further information and assistance. Ask for our checklist of necessary documents or the help table for drawing up a budget. We would be happy to invite you to a preliminary meeting and support you in making further arrangements.

Together we want to ensure that your personal financial planning reflects your individual wishes and needs!

Your team at Ramseier Treuhand AG