Education allowances in accordance with the revised Family Allowances Act

The revision of the Family Allowances Act lowers the lower age limit for education allowances from 16 to 15 years. The following changes were also made with this revision, which came into force on August 1, 2020: Firstly, unemployed mothers are now entitled to family allowances from the beginning of August. Secondly, a legal basis was created for financial assistance to family organizations.

The following article focuses exclusively on education allowances. Information on the other two changes can be found on the homepage of the Federal Social Insurance Office (FSIO).

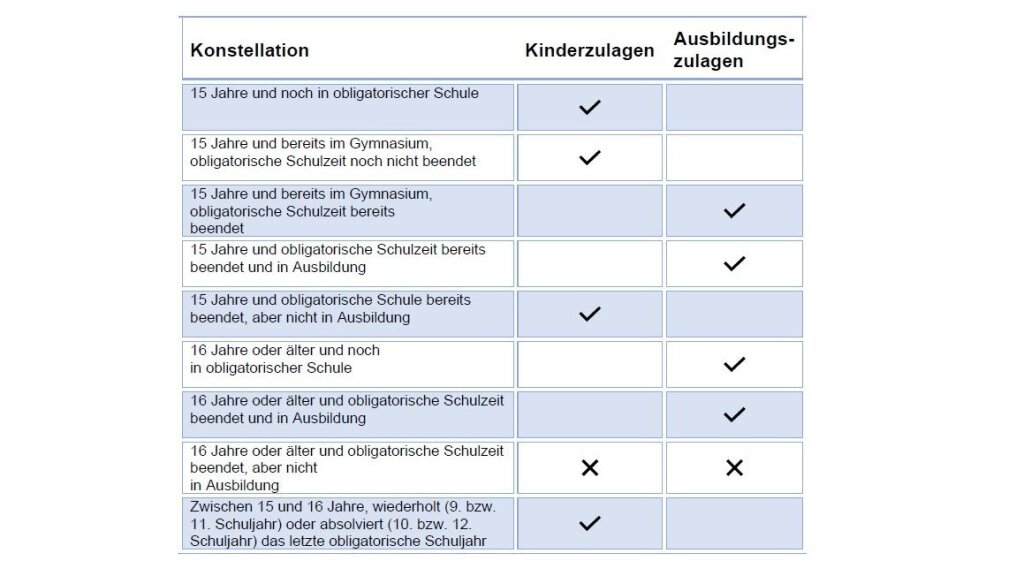

In the case of family allowances, a distinction is made between education allowances and child allowances. These two types of allowances differ in the amount of the benefit and in the eligibility requirements. Child allowances are generally lower. They are paid for children up to the age of 16 or until they are entitled to education allowances. Education allowances, on the other hand, are intended for young people who are completing post-compulsory education, but at the earliest - now - from the age of 15.

Eligibility requirements and beneficiaries

In order to be entitled to an education allowance, the child must

have completed their compulsory schooling (cantonal regulations vary!),

are in post-compulsory education, and

be at least 15 years old.

The entitlement arises at the earliest on the first day of the month in which the child turns 15.

Post-compulsory education is defined as when young people systematically and predominantly prepare for a vocational qualification on the basis of a recognized course of education or acquire a general education that serves as a basis for various professions. Typically, apprenticeships as well as grammar schools, technical colleges, etc. fall under this category.

In this context, systematic means a course of study lasting at least four weeks. The term "predominantly time-based" implies a time commitment of at least 20 hours per week, which is to be understood in the form of school lessons, lectures, courses, preparation and follow-up work, self-study, writing a thesis, distance learning, etc.

Important: The earned income or replacement income of the child must not exceed CHF 2,370 per month (gross salary).

Performance

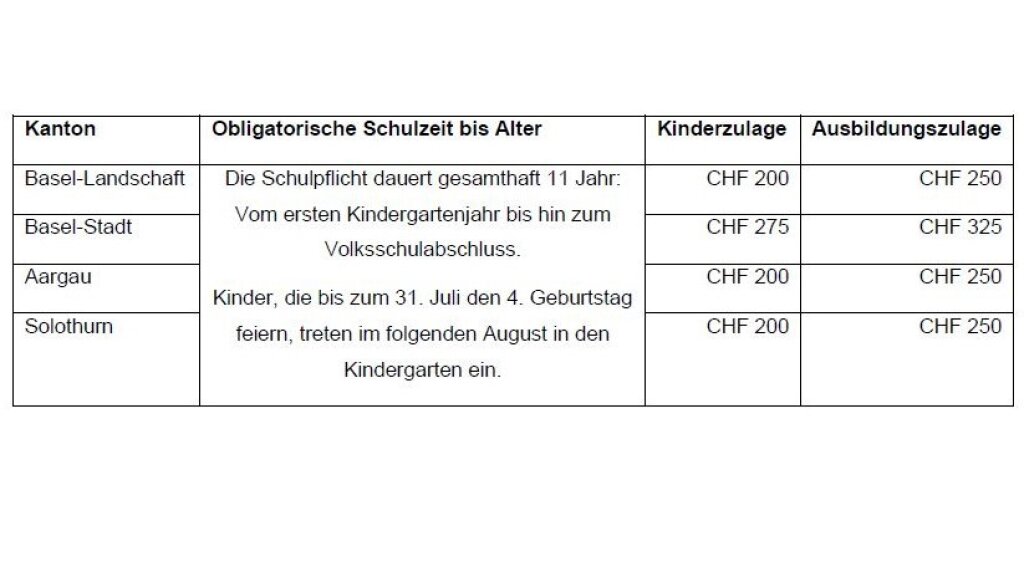

The federal government sets minimum rates: These are CHF 200 per month for child allowances and CHF 250 per month for education allowances. However, the cantons can set higher allowances - see Federal Social Insurance Office (FSIO).

The following approaches apply in Northwestern Switzerland:

Duration

If the above conditions are met, the education allowances are paid for the full month in which the child starts education. The entitlement ends with the completion of the education, but at the latest at the end of the month after the 25th birthday.

Procedure/ Process

To make a claim for family allowances, please contact your competent family compensation fund in the respective canton or the fund with which you are insured.

The relevant forms of the individual family compensation funds are linked below.

SVA Basel-Landschaft

Compensation Office Basel-Stadt

SVA Aargau

Compensation Fund of the Canton of Solothurn

Medisuisse

Fact sheet on education allowances from August 1, 2020