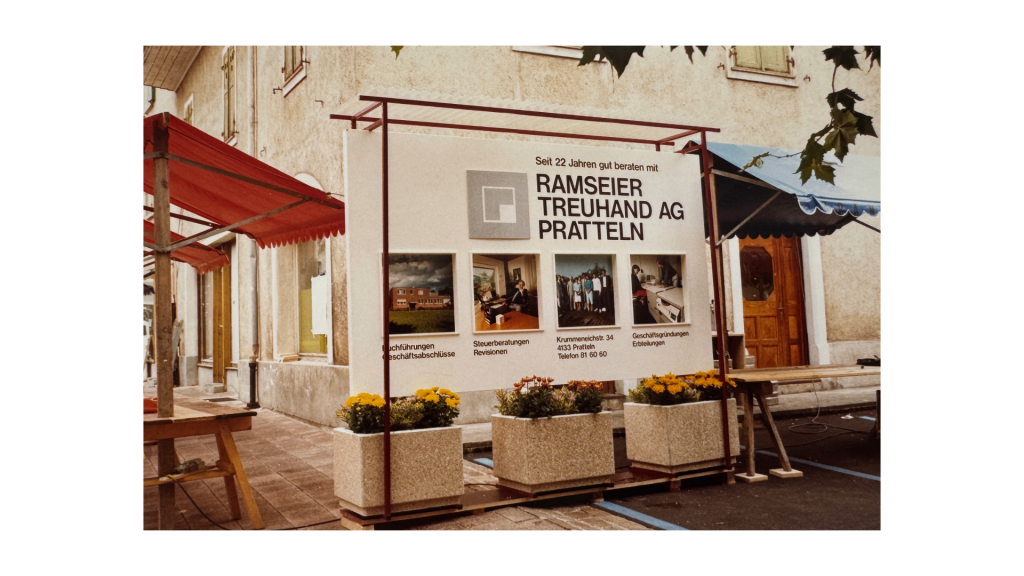

EXPERT Info 3/2022

EXPERTsuisse publishes the EXPERT INFO magazine several times a year with relevant practical information, especially for SMEs. The following brief overview provides an initial insight into the topics. The complete EXPERT INFO is available under "Downloads".

CONTENTS

Tax implications of solar systems (photovoltaic systems)

Investments in photovoltaic systems are tax-deductible as expenses for energy-saving and environmental protection measures for direct federal tax purposes and for most cantons as maintenance costs. The following conditions must be observed:

Installation of the system at least one year after completion of the new building or total renovation

Property has been occupied for at least one year

The practical application of the time limits differs between the cantons.

In the case of direct federal tax, the investment costs can be carried forward to the two following tax periods if the costs cannot be fully taken into account in one tax year. Subsidies must be taken into account in the deduction so that the net investment (costs less subsidy) can be deducted from taxable income. If there is a time lag between the investment costs and the subsidy between two tax periods, the subsidy is taxable in other income. Feed-in tariffs constitute taxable income, while self-consumption is treated differently.

Conditional profit sharing for à-fonds-perdu contributions

In order to prevent overcompensation, a conditional profit-sharing scheme has been incorporated into the legal basis for Covid hardship compensation. As a result, companies with sales of over CHF 5 million and an annual profit in the 2021 reporting year must make a repayment in the amount of the reported profit. The following conditions apply:

The à-fonds-perdu contribution was guaranteed to the company from April 1, 2021

The basis for determining profit is the annual financial statements under commercial law

The principle of consistency must be strictly observed in the annual financial statements

The previous year's loss from the 2022 reporting year is to be deducted from the annual profit as a loss carried forward

If a company is obliged to make a (partial) repayment and the amounts have been recognized in income, the amount to be repaid must be recognized as a provision or, if applicable, as a contingent liability.

The new inheritance law: focus on company succession

In addition to the amendments to inheritance law, which have already been adopted and will come into force on 1 January 2023 (in particular the reduction of compulsory portions), a further bill is currently being drafted with the aim of making company succession more flexible. Key elements of this are

Reduction of the compulsory portion of descendants and elimination of the compulsory portion of parents

Structural changes in the value of a company transferred during lifetime are borne in full by the successor: profit as well as loss

Possible deferral of the compensation payment to the co-heirs

Simplified integral assignment of management

Marriage for all: differences in social security law

Since the middle of the year, same-sex couples have also been allowed to marry or convert their registered partnership into a marriage. Widowers living in a marriage have stricter eligibility requirements for AHV and UVG benefits than widows. To their disadvantage, the widower's solution is applied to registered partners in the event of death, regardless of gender.

The pension fund does not differentiate between widowers and widows with regard to eligibility requirements.